According to the latest Standard & Poor’s (S&P) report, Montenegro and Bosnia and Herzegovina have the lowest credit ratings in the Balkans. Their rating is B+, which basically means “speculative credit capacity, high credit risk.“

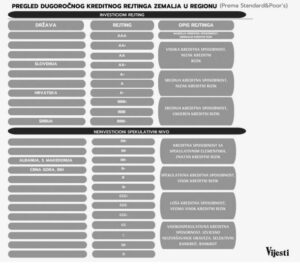

Albania and North Macedonia are one level higher with a BB- rating. Serbia is in a much better position with an investment-grade BBB-, which is four levels above Montenegro. Croatia sits at A- (seven levels higher), while Slovenia is way ahead at AA-, ten levels above.

Why does this matter? Because credit ratings affect how much a country pays in interest when borrowing money. The lower the rating, the higher the interest. And Montenegro has some big loans coming due €821 million this year, €353 million in 2026, and €971 million in 2027. That’s a total of €2.2 billion in the next three years, which will have to be covered with new loans.

The government and the Ministry of Finance presented Montenegro`s unchanged low credit rating with a “stable outlook“ as a big win even though almost all neighbouring countries have moved ahead.

Confirming the country`s credit rating is an encouraging result and a boost for continued positive economic trends. It will help improve citizens living standards, attract more investments, and support major infrastructure projects,“ the Ministry of Finance said in a statement. They also highlighted that investments remain the key driver of growth, supported by ongoing projects in real estate, energy, and tourism.

But official data tells a different story. Montenegro is seeing a growing trade deficit, a drop in tourism revenue, declining foreign direct investments, and slowing DDP growth over the past three quarters.

S&P`s report mentions that Montenegro`s credit rating could improve if fiscal results exceed expectations and public debt starts to decline – which would require strong economic growth.

Right now, though, things are heading in the opposite direction. Fiscal results are below projections, and public debt is rising, not falling. According to Montenegro`s fiscal strategy, net public debt is expected to grow from €4.12 billion to €5.5 billion by 2027, increasing from 58.5% to 63.8% of GDP.

Montenegro`s highest credit rating from S&P was in 2007, when it was BB+ – three levels higher that today and just one step away from investment grade. Back then, Serbia had a BB- rating, two levels below Montenegro. Since then, Serbia has moved three steps up, while Montenegro has dropped three steps down.

It`s kind of wild how things have flipped over the years. Montenegro was ahead of Serbia in 2007, almost making it to investment grade, and now it`s three levels below while Serbia climbed up. The government is spinning this “stable outlook“ as a win, but staying at the bottom isn`s exactly a victory. The reality is that debt is piling up, growth is slowing, and key industries like tourism and foreign investments are struggling. Unless something changes, borrowing will just get more expensive, making it even harder to break out of the cycle. It feels like a wake-up call, but is anyone really listening?

Written by our correspondent A.A.